How do you best elevate your lifestyle when you are on a budget? I have found the best way to elevate your lifestyle is to invest in artistic pieces. Buy beautiful art to look at and stir at, after a day of work that would to take you to a more peaceful and beautiful world. For me, my art collection is limited but it expresses who we are as individuals and as a couple. I have purchased art by a local artist(to show my love of Vancouver and British Columbia), I have also purchased prints by famous artists, one is a contemporary artist and the other is well known celebrated painter. The local art showcases Vancouver’s natural beauty and landscapes, I have two pieces that I purchased for $67 at a local art store on 2535 Main St, called Bird on a Wire. The artist name is Duane Murrin. It is two gorgeous paintings of the landscape of Bristish Columbia. The contemporary artist I own is Leonid Afremov. He just passed away in August 2019. I am in love with his pieces with its vivid colors of dreams of love. The painting I bought was a print of “dreams come true” from Wayfair at a cost of $110. The last of the painting is a by a well known artist Vincent Van gogh. The print I got was a small size canvas painting from Wayfair of cafe terrance by night. It was $67. It reminds me of my goal to travel to France and enjoy a nice drink at a local cafe.

Category: Uncategorized

Saying Goodbye to Renfrew Street, and the decaying Vancouver Suburb

With a new generation, there is a fleeing from the old suburb into the city and urban areas. It has become too expensive to purchase one family housing units in Vancouver, and those that can afford those type of units are investing their money in more upscale and richer neighourhoods like north and west vancouver or less expensive neighbourhoods outside the city core like mission, maple ridge or pitt meadows. What is happening in many Vancouver suburbs like Renfrew is the tearing down of old family style homes, to be replaced by condos and townhouses. This what you see when you walk down the street of Renfrew, beautiful parks with the homes that eventually will be sold off as families begin to move out of this area. Look at all the crows that have now made Renfrew Street their home. In the next few decades much of Renfrew Street, will be condos, townhouses and businesses:

November Budget-Did we meet our monthly budget goals living in Vancouver

Another month has ended. Did we meet our budget goals? With the raise I got in October, I made $2300 for the month of November. Our total family income for the month of November was $4400. We spent for the month of November $4690. We overspent for the month of November by $290. We had to pull from our savings from last month that was $929. Our savings is now $639. Here is a breadown of our finances for the month of November:

| predicted | November Figure actual | ||||

| BC Hydro | $50 | $50 | |||

| Lotto | $80 | $160 | |||

| Fun | $40 | $40 | |||

| Bmo Line | $450 | $474 | |||

| TD paym | $121 | $80 | |||

| St loan | $121 | $89 | |||

| Bank Fees | $11 | $11 | |||

| RBc pay2 | $200 | $218 | |||

| Rent | $1,450 | $1,485 | |||

| BMO PE | $1,200 | $1,555 | |||

| Cibc loan | $20 | $110 | |||

| RBc pay1 | $220 | $250 | |||

| Mutual F | $25 | $25 | |||

| Charity | $22 | $22 | |||

| c rbc loan | $121 | $121 | |||

| total | $4,131 | $4,690 | |||

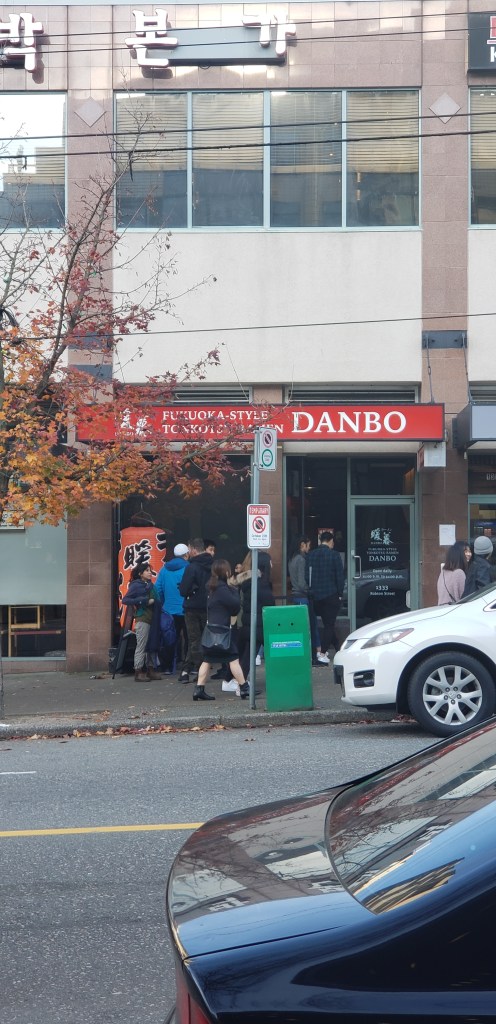

Food Culture in Vancouver’s suburb of Renfrew Street

Renfrew Street is a quieter street. What it may lack in flamboyant display, it offers a few food choices that may surprise you and keep you coming for more.

Mr Sub located @ 2885 Broadway E. At the corner of Broadway E and Renfrew St

All these food choices can be found at 1st ave and Renfrew

Keeping your skin looking young and fresh on a budget

It sometimes can cost an arm and a leg to look young and fresh. Here are the ways I keep people guessing my age incorrectly. I have been mistaken for someone in their twenties, often carded because of my youthful appearance, while in reality I am in my 40’s. Here is what I do to keep my youthful appearance.

- exercise (5 hrs a week) even walking will do

- eat right- smaller portions and healthier options

- sleep- at least 8 hrs per week

- drink water-eight glasses of water a week

- develop a routine and rigid skin regiment- for me I use a cleanser(nivea $10), a toner (nivea $12) and for moisturizer (shea butter $14)

Hopefully this are a few helpful hints!!

Renfrew Street, suburban Vancouver

Renfrew Street is part of a larger area know as Renfrew-Collingwood. It is known as a diverse suburb of Vancouver and its a gateway to Vancouver’s Downtown. Renfrew Street represents the calm before the storm side of Vancouver. It may not appear to be exciting as other areas of Vancouver, however when you look deeper into this area you will find a uniqueness of its own, and its quiet charm shows a side of Vancouver that is slowly disappearing. Here is a few images of Renfrew St:

Saying Goodbye to Robson St, saying Hello to Vancouver Suburb of Renfrew St

It is that time again to say goodbye to another area. We are saying goodbye to Robson street with a look at other pictures we took of this beautiful area. Next week we will be exploring the Vancouver Suburb of Renfrew-Collingwood. This area encompasses a large area of Vancouver East, so we will be limiting the area to just Renfrew St, between 1st street east and 29th St east. So now to show the final pictures of Robson Street:

How should you tackle your debts?

There is a few school of thoughts about how to tackle debt. However there are two that stand out for me and two that I heavily contemplated before making the decision on how to tackle our family debts. We owe students loans, line of credit and credit cards. After moving to Vancouver, we have made the decision to stop accumulating debt and tackle our debts because now that we have the good jobs and we are in a better position to tackle our debts.

The first school of thought is the fast paced debt repayment. This method is advocated by financial advisors like Dave Ramsey. This method requires that all extra monies earned from ones paycheck and also avocates one gets secondary job or side hassles and endorses a full out assault on a individual’s debt. In this method, a person must put aside personal vacation, eating out, investment savings, and spend every earned money that is not used for basic necessity towards debt. This method requires alot of personal sacrifice and a total focus on erasing all debts at a fast pace. This method is not for everyone, however it will get the debts paid off the fastest. It requires alot of personal sacrifice and if you are not ready to sacrifice you may fail at this venture and lead you to more debt. However if you are displined and willing to sacrifice you will have all the debts paid off and you can begin to accumalate wealth. The pros of this method: quick payoff of debt and peace of mind, if both partners are on board with the process, it will increase the strength of the relationship. The cons of this method: too much sacrifice and this extreme method may lead individuals to become demoralized, if either one of the partners is not on board, it will lead to troubles in the relationship

The second school of thought is a balanced approach to paying off thought. It will take a longer process to pay off debt in this case and also it will delay how fast you are able to accumulate wealth because you are going to be paying for more interest over the long run. The balanced approach involves doing the budget and debts in a balanced approach that you failed to do, that is what caused you to go into debt in the first place. It involves setting up several accounts that prepare you for all eventualities, so that you do not need to get further into debt. For example set up a vacation fund, a clothing fund, a debt repayment fund, and create a livable budget that takes into account that minimum you feel you will earn each month. If you surpass that minimum, you can then use the extra amount to distribute between your various funds and accounts you have set up. Over time you will see that your debts will be lowered and that you will be able to enjoy other aspects of your life.

What method have we choosen to pay off our debt? We have choosen the slower method and the balanced method. We will be able to pay all our debts including student loans within 15 years. The only debt we will have is mortage debt, which we hope to get in about 8 years and pay it off before retirement. At the same time we hope to travel, realize our dream of raising a family, save for our retirement, and live a quality life.

Shopping experience on the world famous Vancouver Robson Street

This area of Robson Street offers a shopping experience like many other famed shopping streets such as Rodeo drive in Los Angeles. This is the street to be seen shopping when you are in Vancouver. Here are a few pictures of this area of Vancouver:

October Budget- Did we meet our goal for living in Vancouver in our monthly budget

So, another month is over. Did we meet our financial budget goals for the month of October. We earned for this month including the raise in my income that I talked about in the previous budget blog, a total of $4300. However we spent a total of $4703. We had a savings of $1332. Since we spent more than what we earned for the month, we had to withdraw $403 from our saving. So at the end of the month our savings is $929. Here is a breakdown of our budget:

| predicted | actual | October Figures | |||||

| BC Hydro | $50 | $50 | |||||

| Lotto | $80 | $195 | |||||

| Fun | $40 | $40 | |||||

| Bmo Line | $450 | $479 | |||||

| TD paym | $121 | $80 | |||||

| St loan | $121 | $89 | |||||

| Bank Fees | $11 | $11 | |||||

| RBc pay2 | $200 | $185 | |||||

| Rent | $1,450 | $1,485 | |||||

| BMO PE | $1,200 | $1,555 | |||||

| Cibc loan | $20 | $106 | |||||

| RBc pay1 | $220 | $260 | |||||

| Mutual F | $25 | $25 | |||||

| Charity | $22 | $22 | |||||

| c rbc loan | $121 | $121 | |||||

| total | $4,131 | $4,703 | |||||

Vancouver in the autumn, Queen Elizabeth Park