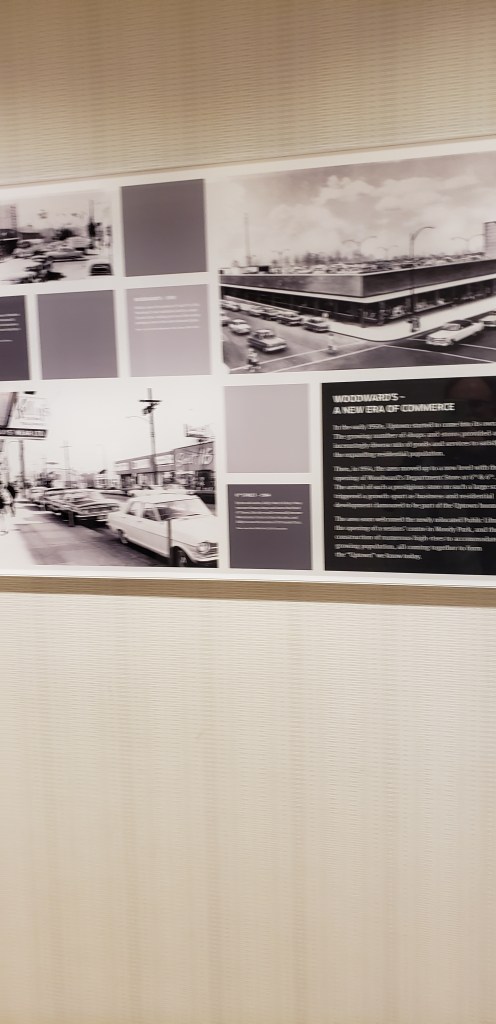

If you like the other white meat and anything pork, Gastown is the place to be. Many pig themed restaurants line the streets along Gastown. Also Gastown is Vancouver’s pub place. Like any older place, pubs are heavily featured in this part of this city. Here are my favorite food choices in Gastown: