We are going to say goodbye to Burnaby Metrotown with the last remaining pictures of the area that has yet to be posted:

We are going to say goodbye to Burnaby Metrotown with the last remaining pictures of the area that has yet to be posted:

I got paid three times this month, so I ended up with $3100 after taxes. The total we made as a couple for the month of May was $5200. We got out tax return. We decided to put $811 from our tax return into our savings account. For the month of May our total spent was $4531. So we have an extra $639 that we can put in our savings. At the end of the month of April we had a total of $845, so the total we have now in our savings account is $2295. This how our financial breakdown looks like:

| predicted | actual | May Figures | |||

| BC Hydro | $50 | $50 | |||

| Lotto | $80 | $160 | |||

| Fun | $40 | $40 | |||

| Bmo Line | $450 | $436 | |||

| TD paym | $121 | $80 | |||

| St loan | $121 | $0 | |||

| Bank Fees | $11 | $11 | |||

| RBc pay2 | $200 | $183 | |||

| Rent | $1,450 | $1,485 | |||

| BMO PE | $1,200 | $1,555 | |||

| Cibc loan | $20 | $110 | |||

| RBc pay1 | $220 | $253 | |||

| Mutual F | $25 | $25 | |||

| Charity | $22 | $22 | |||

| c rbc loan | $121 | $121 | |||

| total | $4,131 | $4,531 | |||

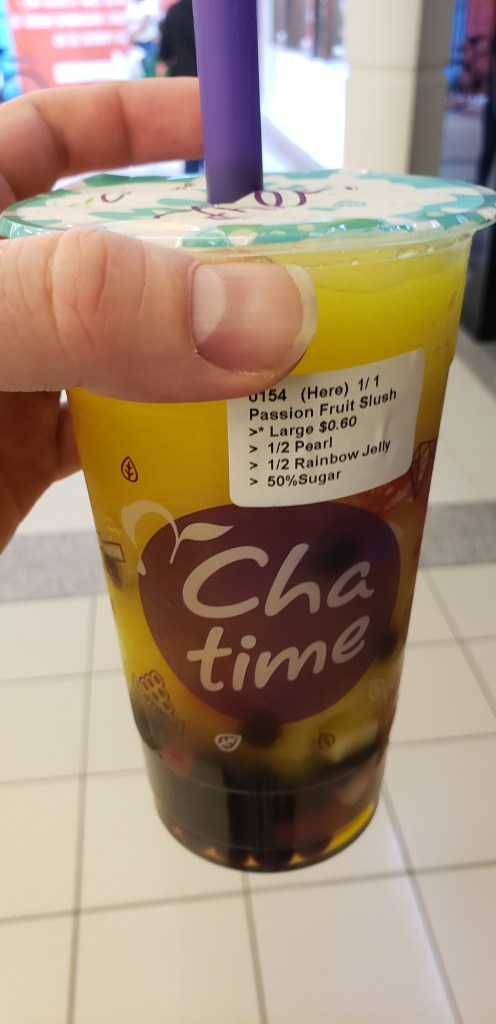

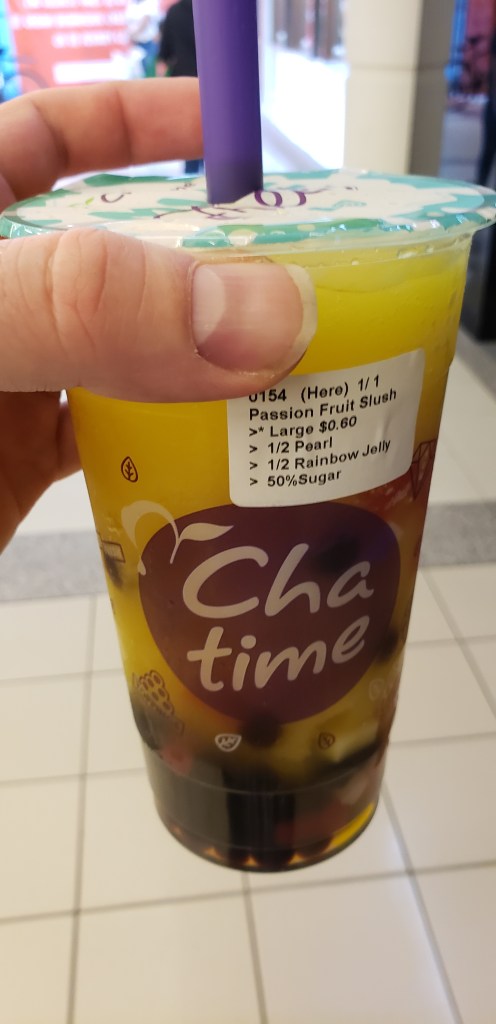

Metrotown is not short of his places to try new desserts. The perfect romantic date may I suggest is romantic stroll to the Burnaby public library in Metrotown, and then a late afternoon snack and dessert at la foret. Maybe if you crave more desserts just look around the entire area, there is no shortage of places to find good dessert. Here is a sample of how the date would like:

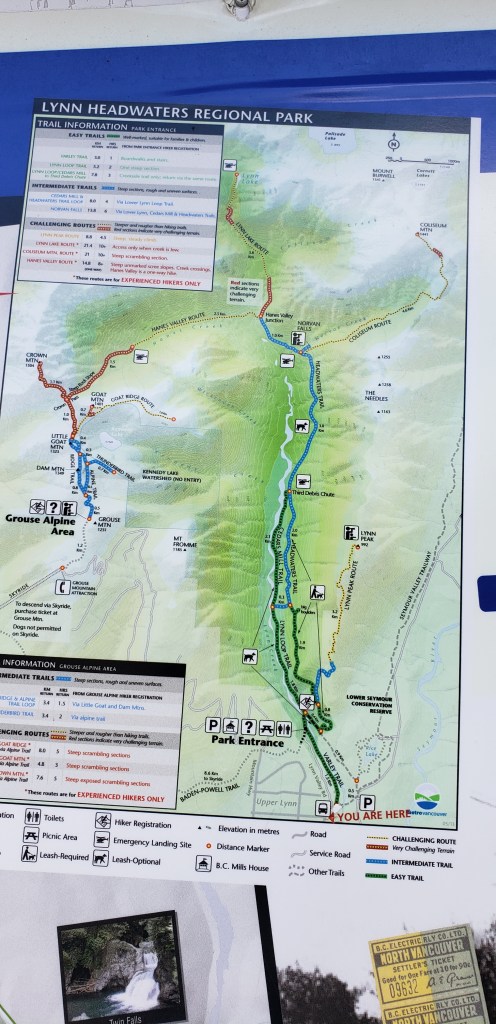

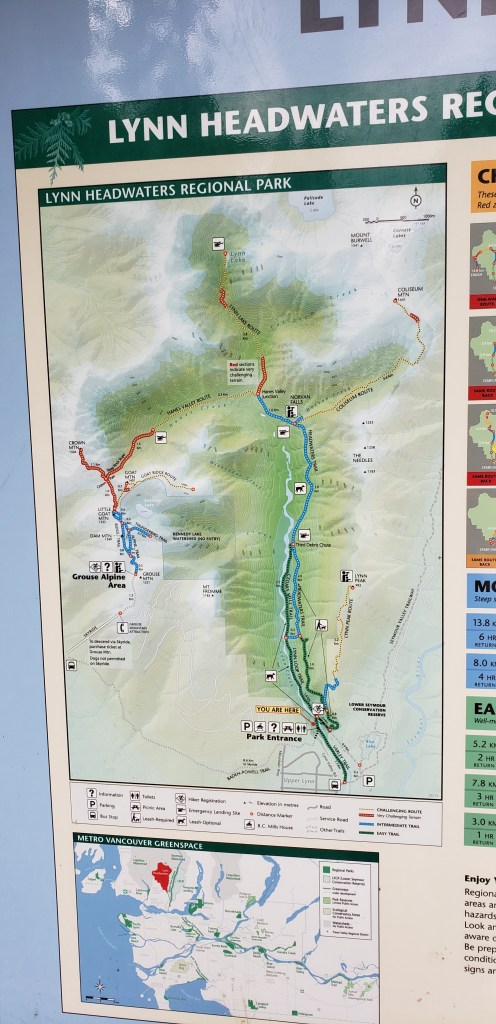

With the pandemic(Covid 19) more under control, and the government lifting restrictions, the British Columbian parks offers the best opportunity to enjoy mother nature and all its glory. A six hour hike is what we enjoyed recently in North Vancouver. We were able to hike in lynn canyon headwaters park. Here are a few pictures of our afternoon in Lynn Canyon:

If you are seeking more tasty treats, it is well advised to not just to look at the metrotown food court, but also the surrounding areas. Crystal Mall is one such a place to look into and explore. Crystal Mall serves a mini-chinatown in the metrotown metropolis. Bring alot of cash on you, since a number of places do not accept debit or credit cards, and just sample and sample.

I love summer. The heat, the sun, the flowers, the smells, the beauty, and the activities. This year has been especially draining because of the pandemic(Covid 19), and it seems that for most part of the beginning of 2020 there was a death. With the beginning of Summer it is now time to enjoy the limited freedom we have, although restricted, it is now time to incorporate some colours into our wardrobe.

The most budget friendly way to incorporate colours into your wardrobe are through accessories. Here are a list of accessories to brigthen uo your wardrobe:

Metrotown has a shopping mall and the surrounding areas have the argubly the best food you will ever find in Vancouver Mainland. Here is my trip into the mall to get good treats:

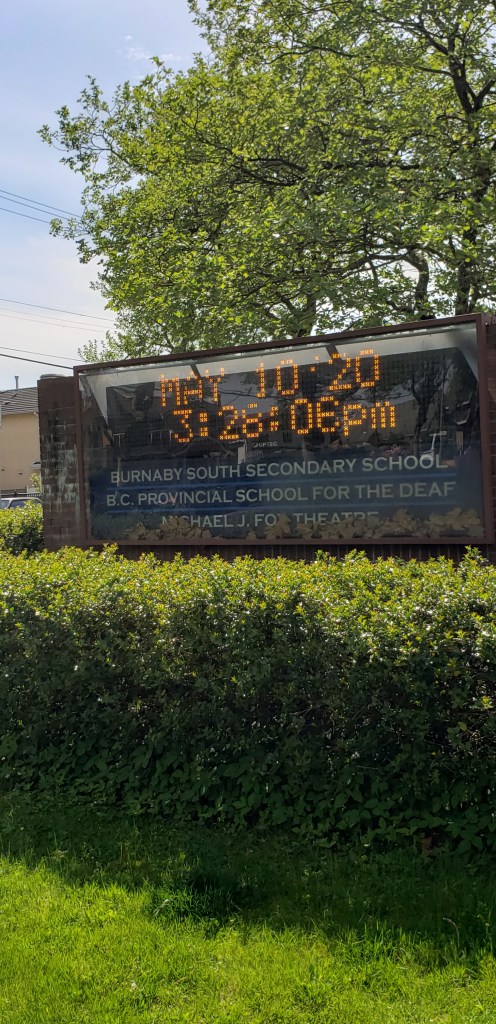

In the previous post I indicated that I grew up in Burnaby. I actually attended Burnaby South High School which is one skytrain ride from the Metrotown Train Station. At the Royal skytrain station is where we find Burnaby South Secondary School, my alma mater. Today we will stroll down memories of my high school days in Burnaby Metrotown:

For the month of April, we earned a total of $4600 after taxes. The amount we spent was $4605. Our savings before the beginning of the month was $849. We had to withdraw $5 from our savings. Going into next month our savings is now $845. Our expenses seem to be going down as the student loan program is cancelled till the end of October. Here is a breakdown of our budget for the month:

| predicted | actual April Figures | |||||

| BC Hydro | $50 | $50 | ||||

| Lotto | $80 | $195 | ||||

| Fun | $40 | $40 | ||||

| Bmo Line | $450 | $442 | ||||

| TD paym | $121 | $80 | ||||

| St loan | $121 | $0 | ||||

| Bank Fees | $11 | $11 | ||||

| RBc pay2 | $200 | $219 | ||||

| Rent | $1,450 | $1,485 | ||||

| BMO PE | $1,200 | $1,555 | ||||

| Cibc loan | $20 | $110 | ||||

| RBc pay1 | $220 | $250 | ||||

| Mutual F | $25 | $25 | ||||

| Charity | $22 | $22 | ||||

| c rbc loan | $121 | $121 | ||||

| total | $4,131 | $4,605 | ||||